Market value of bond calculator

Face Value is the value of the bond at maturity. Yield to Maturity Market Yield - Yield of the bond if held until maturity assuming no missed payments.

How To Calculate Carrying Value Of A Bond With Pictures Cpa Exam Bond Raising Capital

It is a useful guide for landlords and tenants but should not be used alone to determine the market rent of any property.

. The market value annual coupon cash flow and the par value are all used to calculate the bonds yield. By contrast a bonds market value is how much someone will pay for the bond on the free market. CD Calculator Compound Interest Calculator Savings Calculator.

The Coupon This is simply the interest rate on the bond. Youll have a market value and an assessed value the latter of which is quite a bit lower. Example of a Bonds Yield.

Let us see how to calculate the intrinsic value of a stock using our online intrinsic value calculator. Get the latest information and complete track record of Franklin India Ultra Short Bond Fund - Super Institutional Plan schemes returns latest NAV and ratings from independent mutual fund research house. Use the Bond Present Value Calculator to compute the present value of a bond.

Conversely when selling below the par value the bond is said to be trading at a discount. You just bought the bond so we can assume that its current market value is 965. The tax equivalent yield.

Bond Present Value Calculator. Market interest rate represents the return rate similar bonds sold on the market can generate. Lets use the following formula to compute the present value of the maturity amount only of the bond described above.

Plus the calculated results will show the step-by-step solution to the bond valuation formula as well as a chart showing the present values of the par. The bond pays out 21 every six months so this means that the bond pays out 42 every year. Bond Face ValuePar Value - The par or face value of the bond.

The second wave of Covid-19 is ebbing in India with total active cases at less than 20 per cent of May highs. This free online Bond Value Calculator will calculate the expected trading price of a bond given the par value coupon rate market rate interest payments per year and years-to-maturity. Calculating Yield to Maturity on a Zero-coupon Bond.

To use bond price equation you need to input the following. Suppose that a company issues 10-year bonds with a face value of 10000 each and a coupon of 5 annually. Our free online Bond Valuation Calculator makes it easy to calculate the market value of a bond.

F Facepar value. Figure the Market Value of Bonds. To use our free Bond Valuation Calculator just enter in the bond face value months until the bonds maturity date the bond coupon rate percentage the current market rate percentage discount rate and then press the calculate button.

This figure is used to see whether the bond should be sold at a premium a discount or at its face valueas explained below. It is called a coupon because originally there would be a paper coupon attached to the bond that the owner would tear off and. Face value is the amount of money promised to the bondholder upon the bonds maturity.

Annual Coupon Rate is the yield of the bond as of its issue date. Starting with a 25 bond you can buy up to 10000 per year online at TreasuryDirectgov. The ASX bond calculator is used to calculate bond prices and yields for Exchange-traded Australian Government Bonds AGBs and other standard fixed interest bonds.

Enter the earnings per share of the company. Bond price is calculated as the present value of the cash flow generated by the bond namely the coupon payment throughout the life of the bond and the principal payment or the balloon payment at the end of the bonds lifeYou can see how it changes over time in the bond price chart in our calculator. The calculation of YTM takes into account the current market price par value coupon interest rate and time to maturity.

After 30 years EE savings bonds mature and stop accruing interest. Type in the current AAA corporate bond yieldThe current AAA corporate bond yields in the United States are about 422. Annual Market Rate is the current market rate.

Casey Bond is a seasoned. Annual Coupon Rate - Annual interest rate paid out by the bond. It is the basis of everything from a personal savings plan to the long term growth of the stock market.

Input the expected annual growth rate of the company. For example if you receive 5000 now in one lump sum it has more value than receiving 1000 a year for the next 5 years. It returns a clean price and dirty price market price.

This adds cash to its balance sheet and puts it in a stronger financial. The algorithm behind this bond price calculator is based on the formula explained in the following rows. Market value takes into account multiple outside factors.

Bloomberg News describes this as an unprecedented loss in the long history of the bond market. Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance. This data is updated monthly and contains bond information from the previous six months not including the most recent month.

As an example well start with the dollar amounts from above. In the two years following the bond issue the companys earnings rise. Face value is predetermined when the bond is sold.

How to Figure Out the Present Value of a Future Sum of Money. For example the update in July will include bond information from 1 December 31 May. Here is an example calculation for the purchase price of a 1000000 face value bond with a 10 year duration and a 6 annual interest rate.

The idea behind present value is that money you receive today is worth more than the same amount of money if you were to receive it in the future. Years to Maturity - Years that are left until the bond matures. In addition if the marginal tax rate is entered the tax equivalent yield is calculated each year.

It is also assumed that all coupons are reinvested. The current market price of the bond is how much the bond is worth in the current market place. The maturity amount which occurs at the end of the 10th six-month period is represented by FV The present value of 67600 tells us that an investor requiring an 8 per year return compounded semiannually would be willing to invest 67600 in return for a.

156195 crore Ambuja CementsRs. This municipal bond calculator lets a municipal bond investor calculate the yield each year until the bond matures. The Bloomberg Global Aggregate Index a benchmark for the bond market worldwide has tumbled 11 from its peak in January 2021 equating to a drop of 26 trillion in the indexs market value.

Interest gets added to the bond monthly and the government guarantees that the bond will double in value after 20 years. It is also referred to as discount rate or yield to maturity. A bonds face value differs from its market value.

This page contains a bond pricing calculator which tells you what a bond should trade at based upon the par value of the bond and current yields available in the market sometimes known as a yield to price calculator. The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bonds term. Enter the current market price of the share.

It sums the present value of the bonds future cash flows to provide price.

Pin On Forex Signals

How To Calculate Sum Of Squares Sum Of Squares Sum Standard Deviation

How To Calculate Rate Of Return On Maturity From A Money Back Life Insurance Policy Life Insurance Policy Credit Card App Insurance Money

Pin On Ch 4 Bond Valuation

Bond Price Calculator Online Financial Calculator To Calculate Pricing Valuation Of Bond Based Financial Calculator Financial Calculators Price Calculator

Solved Sincere Stationery Corporation Solutionzip Solutions Corporate Solving

Bond Yield Calculator Online And Free Www Investingcalc Bond Yield Calculator Free Coupon Rate Current Yield Investing Money How To Get Rich Bond

Free Online Altman Z Score Calculator At Www Investingcalc How To Get Rich Investing Money Investing

Models For Calculating Cost Of Equity Accounting Books Equity Accounting And Finance

Calculate Dhrxn For The Combustion Of Octane C8h18 By Using Average Bond Energies In 2022 Octane Bond Calculator

Semiannual Coupon Bond Valuation Mgt232 Lecture In Hindi Urdu 10 Youtube Lecture Business Finance Bond

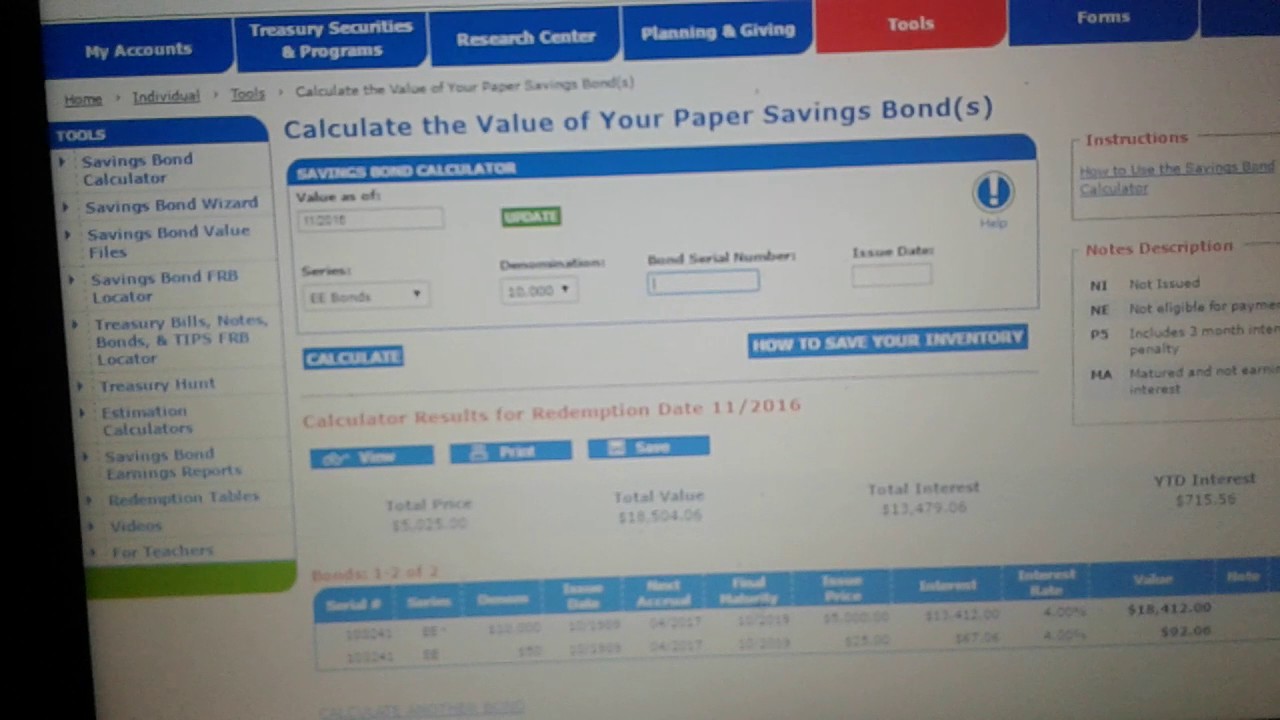

Finding Your Treasury Direct Bond On The Calculator Bond Birth Certificate Statement Template

Bond Value Calculator Used To Track Price Of Any Bond Corporate Bonds Bond Market Debt Capital Markets

Bonds Valuation And Theory Mgt330 Lecture In Hindi Urdu 13 Youtube Lecture Financial Management Bond

Actionable 100 Year Analysis Of S P 500 What S The Best Strategy To Maximize Returns Strategies Investing Stock Market

How To Calculate Diluted Eps Financial Analysis Basic Concepts Financial

How To Calculate Value At Risk Var In Excel Investing Standard Deviation Understanding